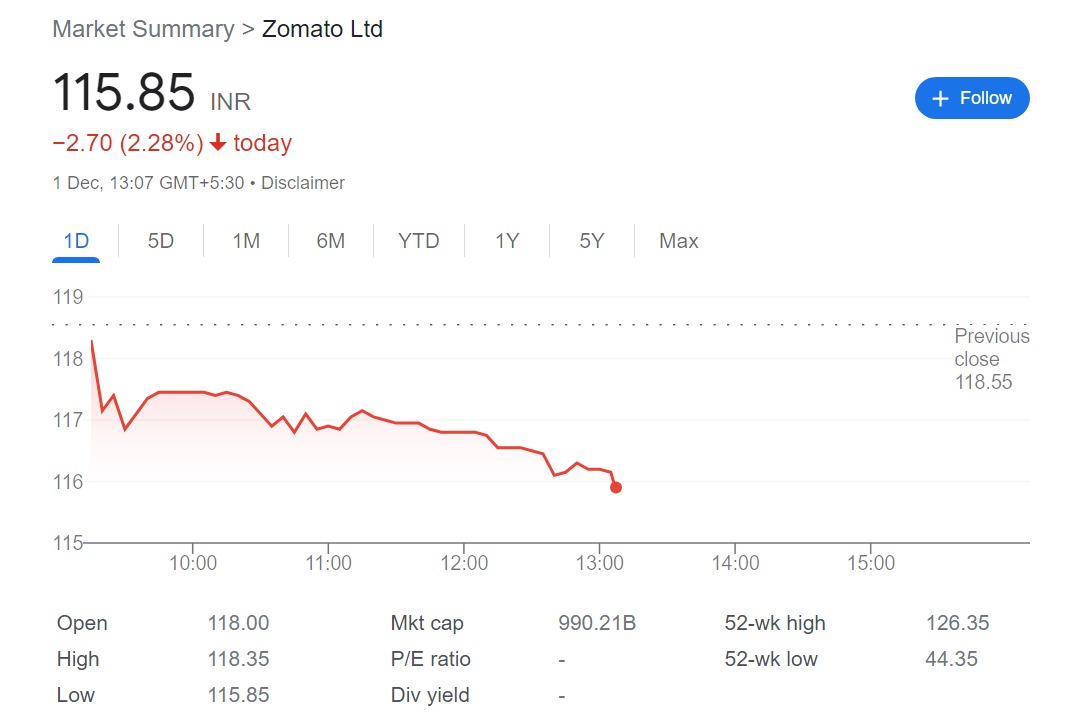

Zomato Share – Zomato Ltd, one of India’s leading online food delivery platforms, saw its share price decline by 1.55% on Monday, closing at Rs 114.70 on the National Stock Exchange (NSE). The company, which went public in July this year, has been facing stiff competition from rivals such as Swiggy, Amazon Food, and Dunzo, as well as regulatory challenges from various states over its business model and practices.

READ

Zomato, which operates in over 500 cities across India, reported a net profit of Rs 360 crore for the quarter ended September 30, 2023, compared to a net loss of Rs 101 crore in the same period last year. However, the company’s revenue growth slowed down to 71.43% year-on-year, from 94.25% in the previous quarter.

Impact of COVID-19 and Revenue Growth Slowdown

The company’s revenue growth slowed to 71.43% year-on-year, down from 94.25% in the previous quarter, attributing the decline to the lingering effects of the second wave of the COVID-19 pandemic. The pandemic significantly disrupted the demand and supply dynamics of food delivery services, impacting Zomato’s performance.

Zomato also faced regulatory headwinds in several states, such as Maharashtra, Karnataka, Tamil Nadu, and Gujarat, where it was accused of violating labor laws, consumer protection norms, and tax regulations. The company faced protests from its delivery partners over issues such as low wages, incentives, and working conditions. Zomato also faced backlash from some restaurant owners and associations, who alleged that the company was charging high commissions, imposing unfair terms, and engaging in predatory pricing.

Share Price Performance and Outlook

Zomato’s share price has fallen by over 9% since its listing on July 23, 2023, when it debuted at Rs 126.35 per share. The company, which has a market capitalization of Rs 98,651 crore, is trading at a price-to-book ratio of 5.15, which is higher than the sector average of 3.39. Analysts have mixed views on the company’s prospects, with some recommending a buy, while others suggesting a hold or sell.

Zomato recently announced strategic partnerships with local restaurant associations and labor unions to address concerns raised by delivery partners regarding wages, incentives, and working conditions. The company aims to improve relations with stakeholders and enhance operational transparency amidst ongoing regulatory scrutiny and competitive pressures.