The digital finance arm of Reliance Industries Ltd. and the group’s unit Jio Financial Services Ltd. delivered a strong performance in Q2 FY 24 that pushed the stock higher to close on Wednesday, up by 2.37% to ₹226.70 .

I&T Finance Shares Price soar after company makes this smart move

Surging Decent Quarterly Results On the day

The company announced astounding net income of ₹6.68 billion for the quarter ended on September 30, 2023, registering a 109.89 % growth year-over-year period. Such an excellent performance was driven by the vast array of the company’s financial products and services, including lending and banking, insurance, payments, wealth management, and advisory services to provide an all-in-one financial suite offering.

Revenue growth and Segment performance

The total revenue increased by a remarkable 6.08% from the previous year to ₹6.08 billion mainly driven by the performance of the digital lending segment. The segment performed exceptionally well with a 12% growth in loan disbursements and a 15% reduction in the NPA leading to significant revenue growth.

Strategic Partnerships and Operational Efficiency

Jio Financial Services also capitalized on strategic partnerships with players in the fintech sector such as Zomato, IRB Infrastructure, and CDSL, facilitating the provision of innovative products and services thus further enhancing its revenue streams. Notably, the company managed its operating expense well at ₹714.20 million thus portraying strong operational efficiency and cost optimization. Jio Financial Services additionally recorded an effective tax rate of 11.43%, compared to the industry average of 15%.

Market Performance and Growth Trajectory

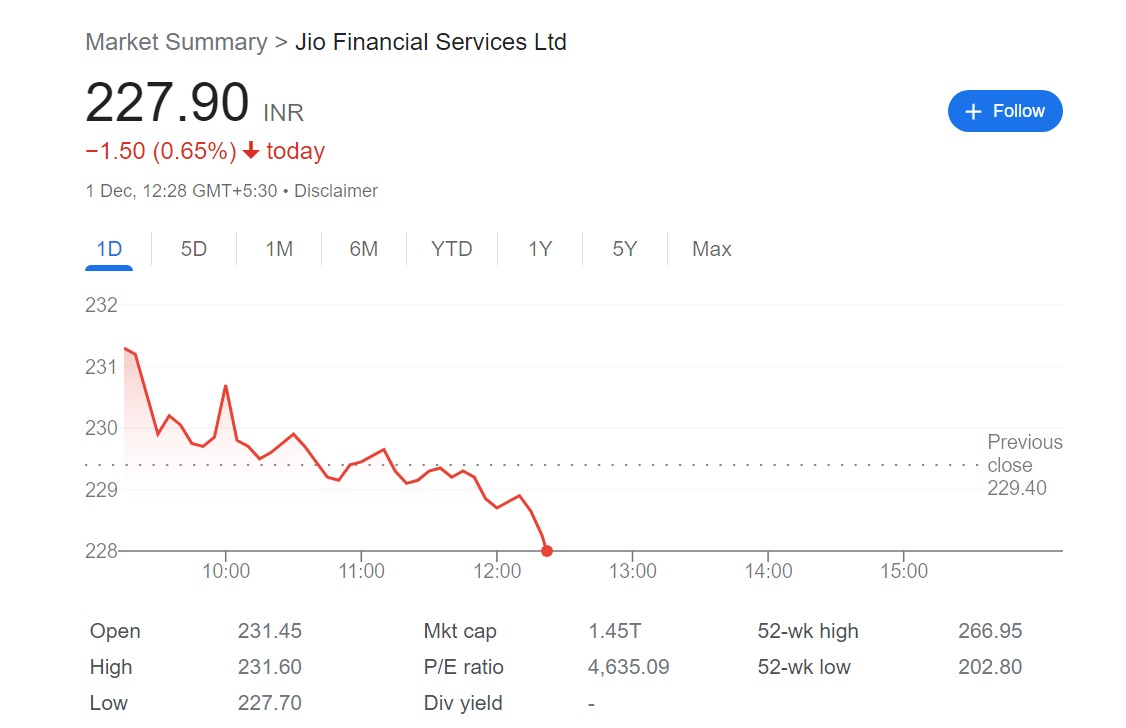

Jio Financial Services has established itself as the second-largest operator in the finance-others sector, with Tata Steel Ltd. as the only company ahead of it. Despite underperforming the NSE Finance – Others index with a surprising 7.89% one-month return rank, its share price has increased by 11.8% in that time to a market capitalization of 143,90bn.

Confidence in the Future Management

The board of directors is convinced that the company will achieve sustainability by utilizing digital platforms, obtaining insights from data analytics, and implementing consumer-centric models to benefit shareholders. Furthermore, Isha Ambani’s appointment to the RBI endorsed the company’s long-term strategic goals and directorial ambitions.