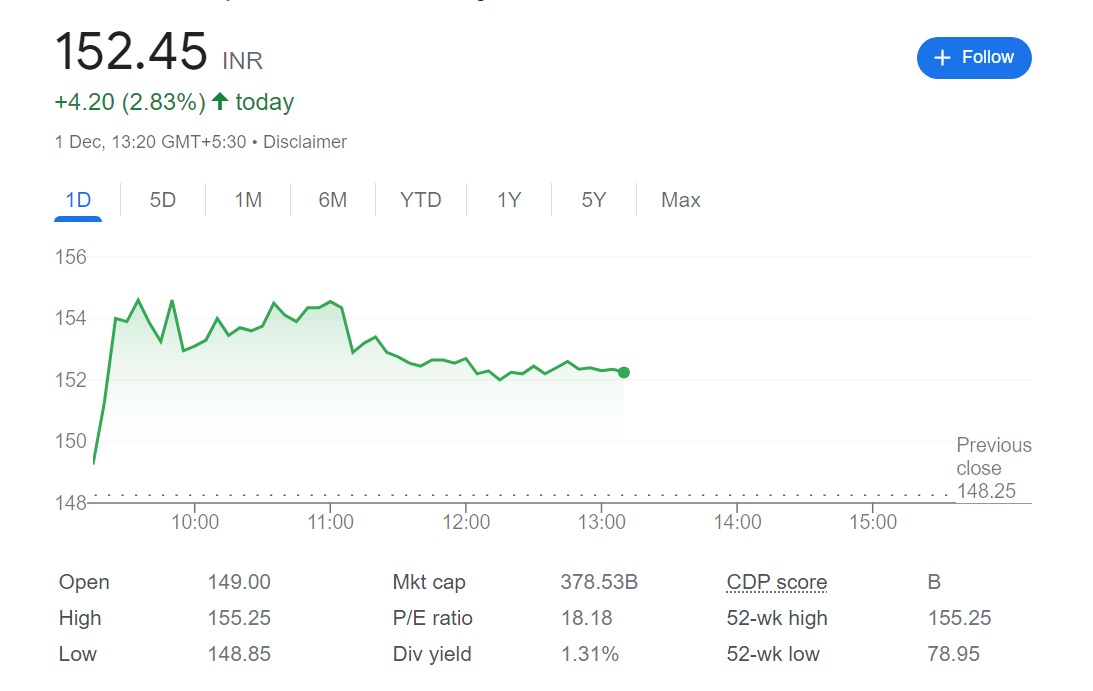

I&T Finance Shares Price – I&T Finance Ltd, a leading non-banking financial company (NBFC) in India, saw its share price surge by 10.23% on Friday, closing at Rs 128.25 on the National Stock Exchange (NSE). The company, which provides loans and financial services to various sectors such as infrastructure, renewable energy, rural finance, and housing, announced that it has entered into a definitive agreement to merge with IDFC Ltd, a diversified financial conglomerate.

READ

Creating a Financial Services Powerhouse

The merger, which is subject to regulatory and shareholder approvals, will create one of the largest and most diversified financial services groups in India, with a combined asset base of over Rs 2.5 lakh crore and a customer base of over 20 million. The merged entity will have a presence across banking, asset management, insurance, broking, wealth management, and advisory services.

According to the terms of the agreement, IDFC shareholders will receive 139 shares of I&T Finance for every 10 shares of IDFC held by them. The swap ratio implies a premium of 15.5% for IDFC shareholders based on the closing prices of both companies on Friday. The merger is expected to be completed by the end of the fiscal year 2024-25.

Unlocking Value and Potential

The management of both companies said that the merger will create significant value for the shareholders, customers, and employees of both entities, as it will leverage the complementary strengths, synergies, and growth opportunities of the combined group. The merger will also enable the group to diversify its revenue streams, optimize its capital structure, enhance its operational efficiency, and expand its digital capabilities.

Positive Market Reaction

The market reacted positively to the merger announcement, as both stocks witnessed heavy buying interest on Monday. I&T Finance shares touched an intraday high of Rs 131.80, while IDFC shares rose by 9.81% to close at Rs 125.65 on the NSE. Analysts have given a thumbs up to the deal, saying that it will create a strong and well-capitalized financial services player in the Indian market, with the potential to deliver superior returns in the long term.

As of recent developments, regulatory approvals for the merger are progressing smoothly. The companies remain optimistic about completing the merger by the end of the fiscal year 2024-25, paving the way for the formation of one of India’s largest financial conglomerates.