TIAA, formerly known as the Teachers Insurance and Annuity Association, boasts a nearly century-long history of providing retirement plans, annuities, IRAs, and mutual funds, claiming to prioritize customer value through lower fees and expert advice.

Shocking Allegations

Recent investigations by the Wall Street Journal have uncovered troubling practices within TIAA, suggesting that the company may not be as trustworthy as it portrays itself.

Sales Pressure Tactics

Reports indicate that TIAA has been exerting pressure on its financial advisors to promote higher-cost products to customers, potentially putting their retirement savings at risk.

Deceptive Marketing Maneuvers

TIAA allegedly employs deceptive tactics to channel customers towards its bank, EverBank (now TIAA Bank), without transparently disclosing the implications and differences between the entities.

Customer Backlash and Legal Action

Outraged customers have lodged complaints and legal actions against TIAA, accusing the company of breach of contract, fraud, and negligence.

TIAA’s Response

TIAA refutes the allegations, asserting that its practices align with customer interests and dismissing the investigative report as inaccurate.

Reevaluating Your Relationship

Given the revelations, customers are urged to reassess their association with TIAA and explore alternative options to safeguard their retirement funds.

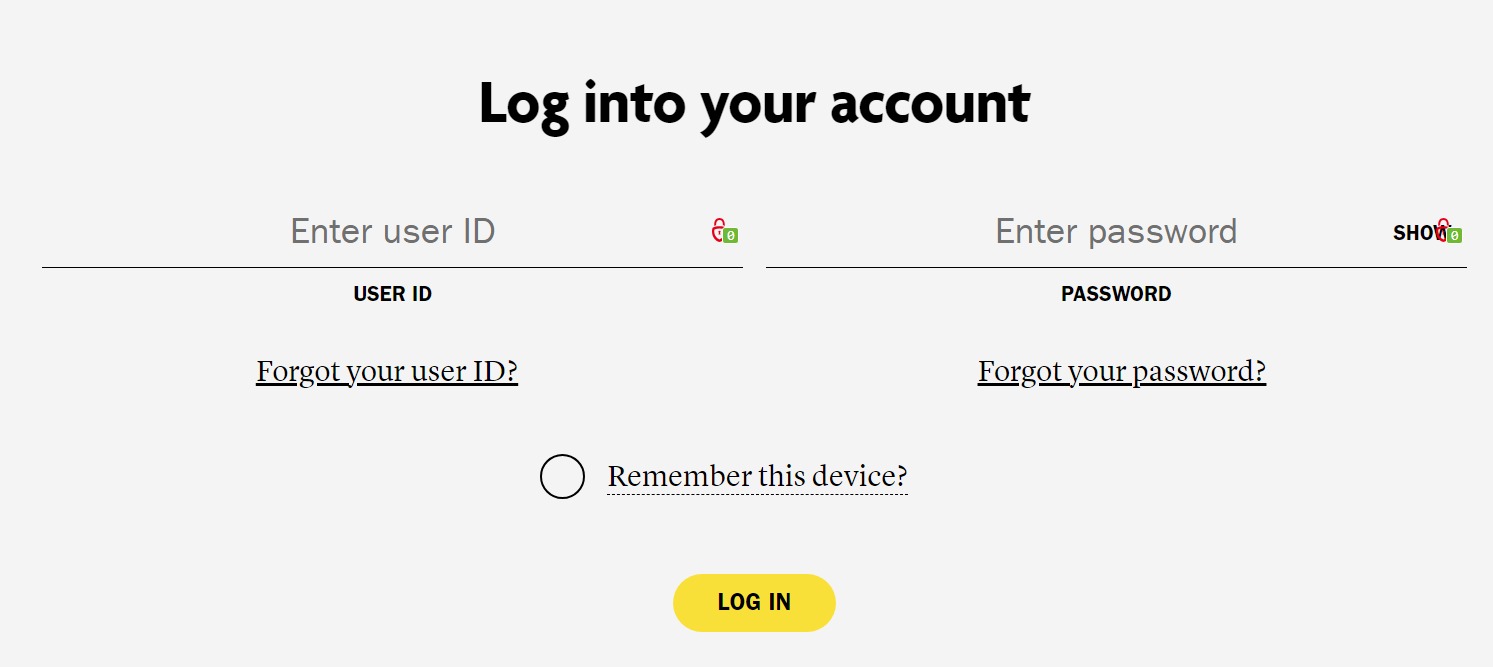

Verifying the Truth

Customers are encouraged to log in to their accounts to ascertain the reality of TIAA’s actions regarding their money and make informed decisions about their financial future.