Streamlining Your Payroll Processes: The Ultimate Guide to Understanding How Payroll Companies Work. In today’s fast-paced business landscape, managing various aspects of your company efficiently is crucial to ensure smooth operations. One such critical aspect is payroll management. Companies of all sizes, from startups to large enterprises, understand the importance of accurate and timely payroll processing. This article aims to provide a comprehensive guide to how payroll companies work, shedding light on their processes, benefits, and why outsourcing payroll might be the right choice for your business.

Understanding Payroll Companies

Payroll companies, also known as payroll service providers, offer specialized services to businesses to manage their employee compensation, benefits, and tax-related matters. These companies take on the responsibility of calculating wages, withholding taxes, distributing paychecks, and handling various administrative tasks associated with payroll.

READ ALSO;

- Unveiling the Impact of TV Business News on Modern Industries

- Unveiling the Significance of Insurers in Safeguarding Your Future

- Unlocking Opportunities: Business Loan Investors for Your Growth

- Unleashing the Power of Business Telecommunications Services for Enhanced Efficiency

- Unveiling the Truth: Did Mark Zuckerberg Really Sell Facebook?

Key Functions of Payroll Companies

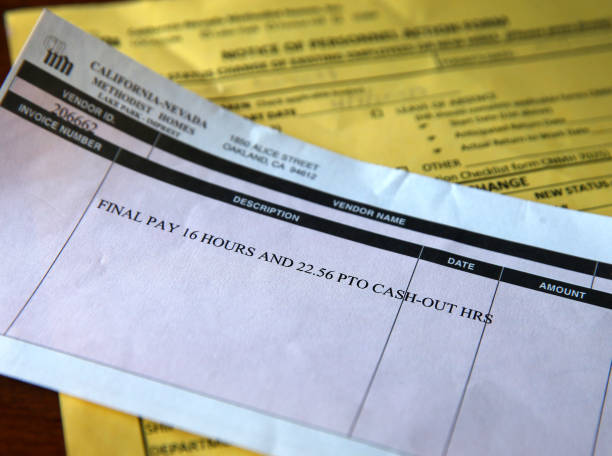

1. Accurate Payroll Processing

Accurate payroll processing is at the core of what payroll companies do. They handle tasks such as calculating employee salaries, factoring in overtime and bonuses, and ensuring that all calculations are error-free. This meticulous attention to detail helps prevent costly mistakes and ensures employees are paid correctly and on time.

2. Tax Deductions and Filings

Navigating the complex landscape of payroll taxes can be challenging for businesses. Payroll companies are well-versed in tax regulations and ensure that the correct amount of taxes is withheld from employees’ paychecks. They also handle the timely filing of payroll-related taxes, reducing the risk of penalties for non-compliance.

3. Direct Deposits and Payment Distribution

Gone are the days of distributing physical paychecks. Payroll companies offer the convenience of direct deposit, ensuring that employees’ salaries are deposited directly into their bank accounts. This streamlines the payment process and eliminates the need for manual check distribution.

4. Employee Self-Service Portals

Many payroll companies provide employee self-service portals. These online platforms allow employees to access their pay stubs, tax forms, and other relevant information. This self-service model enhances transparency and empowers employees to manage their payroll-related details independently.

5. Compliance and Regulations

Staying compliant with ever-changing labor and tax regulations is a daunting task. Payroll companies stay up-to-date with these regulations, ensuring that your business remains compliant and avoids legal complications.

Benefits of Using Payroll Companies

Time and Resource Savings

Outsourcing payroll functions extends far beyond the realm of convenience; it’s a strategic move that liberates valuable time and resources for businesses. Imagine the hours typically spent grappling with intricate payroll calculations and tax obligations now redirected towards fostering innovation and propelling the company’s growth trajectory. With the intricacies of payroll management expertly handled by external professionals, your HR team gains the bandwidth to delve into strategic initiatives, employee development, and initiatives that drive business expansion.

Accuracy and Error Reduction

The art of payroll is a delicate ballet that demands precision at every step. Payroll errors can have far-reaching consequences, from disgruntled employees to potential legal entanglements. Here’s where the meticulous accuracy of payroll companies shines. Armed with cutting-edge software and an unwavering commitment to precision, these companies curtail the risk of errors in calculations, deductions, and tax filings. The result? A harmonious payroll process that resonates with accuracy, consistency, and content employees.

Expertise and Industry Knowledge

Navigating the labyrinth of payroll regulations, tax codes, and compliance mandates demands a level of expertise that only seasoned professionals can provide. Payroll companies house dedicated experts who boast an intimate understanding of the ever-evolving landscape of payroll intricacies. Their familiarity with the latest regulations ensures that your company remains firmly aligned with legal requirements, minimizing the potential for penalties and legal repercussions. This depth of knowledge provides not only peace of mind but also an opportunity to focus on core business operations.

Data Security

Handling the sensitive tapestry of employee data requires the fortification of ironclad security measures. Payroll companies recognize the paramount importance of data security and implement advanced protocols to safeguard the confidentiality and integrity of employee information. From encryption techniques to secure data storage, these measures act as a digital fortress, shielding employee data from the perils of cyber threats and breaches.

Scalability

As businesses evolve, their workforce naturally experiences growth and transformation. Whether you’re embracing expansion, diversifying your employee base, or venturing into new locations, the scalability of payroll companies proves invaluable. These adept partners seamlessly accommodate the evolving intricacies of your payroll requirements. From onboarding new employees to adapting to varied pay structures, payroll companies ensure that your payroll processes remain fluid and streamlined, irrespective of the growth trajectory your business embarks upon.

In essence, the benefits of embracing payroll companies reverberate beyond the realm of convenience. They intertwine with the very fabric of operational efficiency, accuracy, and strategic focus. By entrusting payroll intricacies to these experts, businesses weave a tapestry of seamless processes, fortified compliance, and contented employees – a narrative where each thread contributes to a harmonious symphony of business success.

Is Outsourcing Payroll Right for Your Business?

Outsourcing payroll is a strategic decision that depends on your business’s unique needs and goals. Consider factors such as company size, budget, and the complexity of your payroll processes. If you’re looking to streamline operations, reduce errors, and ensure compliance while focusing on core business activities, outsourcing payroll could be an excellent choice.

In Conclusion

As the business landscape evolves, embracing payroll automation through specialized companies is a strategic move. The benefits of accuracy, time savings, compliance, and employee satisfaction make outsourcing payroll functions an attractive proposition. By partnering with the right payroll company, you’re not just streamlining your payroll processes; you’re also empowering your business for growth and success.

Payroll Companies: Frequently Asked Questions (FAQ)

1. What Exactly Do Payroll Companies Do?

Payroll companies specialize in managing various aspects of employee compensation and payroll processing. Their services include calculating wages, withholding taxes, distributing paychecks, handling tax filings, and ensuring compliance with labor and tax regulations.

2. Why Should I Consider Using a Payroll Company?

Using a payroll company offers several benefits, such as enhanced accuracy in payroll processing, time and resource savings, compliance assurance, and the ability to offer employees self-service portals for accessing pay information.

3. How Does Payroll Automation Work?

Payroll automation involves using advanced software to streamline the entire payroll process. This software calculates wages, applies deductions, generates paychecks, and handles tax withholdings automatically, reducing the chances of errors and saving time.

4. Can Payroll Companies Handle Tax Matters?

Yes, payroll companies are well-versed in tax regulations. They handle tax matters, including calculating and withholding the correct amount of taxes from employees’ paychecks, filing tax returns, and providing the necessary tax-related documents.

5. How Do Payroll Companies Ensure Data Security?

Payroll companies prioritize data security through robust cybersecurity measures. They implement encryption, secure servers, and access controls to safeguard sensitive employee information from unauthorized access and breaches.

6. Are Payroll Companies Suitable for Small Businesses?

Yes, payroll companies cater to businesses of all sizes, including small businesses. Outsourcing payroll functions allows small businesses to focus on growth and core activities without the burden of time-consuming payroll tasks.

7. What Is the Process of Switching to a Payroll Company?

The process typically involves data collection, where you provide employee information and relevant data to the payroll company. They then set up your payroll in their system, calculate wages, process payments, and handle tax filings on your behalf.

8. How Can I Choose the Right Payroll Company?

When selecting a payroll company, consider factors such as their experience, technology, customization options, customer support, and transparency in pricing and processes. Look for a company that aligns with your business’s unique needs.

9. Are Payroll Companies Cost-Effective?

Yes, payroll companies can be cost-effective in the long run. While there’s a fee for their services, the time and resources saved by outsourcing payroll functions can outweigh the costs, especially considering the reduced risk of errors and compliance issues.

10. Can I Customize Payroll Services According to My Business Needs?

Many payroll companies offer customization options to tailor their services to your business needs. Whether you have unique pay structures, benefit plans, or reporting requirements, you can discuss your specific needs with the payroll company.

11. How Can Payroll Companies Help Ensure Compliance?

Payroll companies stay updated on labor and tax regulations, ensuring that your payroll processes remain compliant. They handle tax calculations, filings, and reporting, reducing the risk of legal penalties for non-compliance.

12. Are Payroll Companies Only About Automation?

While automation is a significant aspect of payroll companies, their services go beyond that. They offer expertise in tax regulations, compliance, data security, and customer support, providing comprehensive solutions for payroll management.

13. Can Payroll Companies Handle Different Payment Methods?

Yes, payroll companies offer various payment methods. Direct deposit is a common choice, but they can also accommodate other methods based on your employees’ preferences and your business’s requirements.

14. How Do Employee Self-Service Portals Work?

Employee self-service portals are online platforms that allow employees to access their pay stubs, tax forms, and other payroll-related information. Employees can log in to these portals to view their pay history and manage their details independently.

15. Are Payroll Companies Only for Large Corporations?

No, payroll companies serve businesses of all sizes, including startups and small businesses. Outsourcing payroll functions can be particularly beneficial for smaller companies that want to allocate resources efficiently.

In Conclusion

Payroll companies play a vital role in simplifying and optimizing payroll processes for businesses. From accuracy and compliance to time savings and data security, their services offer a holistic approach to managing employee compensation. By addressing common questions and concerns, this FAQ aims to provide clarity and insight into the world of payroll companies.