Online Savings Account: No Minimum Deposit Required. In a world where financial stability and security are paramount, the quest for a savings solution that accommodates everyone’s needs is an ongoing pursuit. Traditional savings accounts have long been a staple for individuals seeking a safe haven for their hard-earned money. However, the barriers imposed by minimum deposit requirements have often left aspiring savers disheartened, feeling excluded from the world of prudent financial planning. But fear not, for a new era of financial inclusivity has emerged with the advent of online savings accounts with no minimum deposit.

Imagine a financial landscape where access to savings accounts is not determined by the size of your initial deposit, but rather by your determination to build a brighter financial future. It is within this realm that online savings accounts shine, revolutionizing the way we approach saving and investing. In this comprehensive article, we will delve into the multifaceted benefits of online savings accounts with no minimum deposit, exploring how they have become the driving force behind financial empowerment for a diverse range of individuals.

The Revolution of Online Savings Accounts

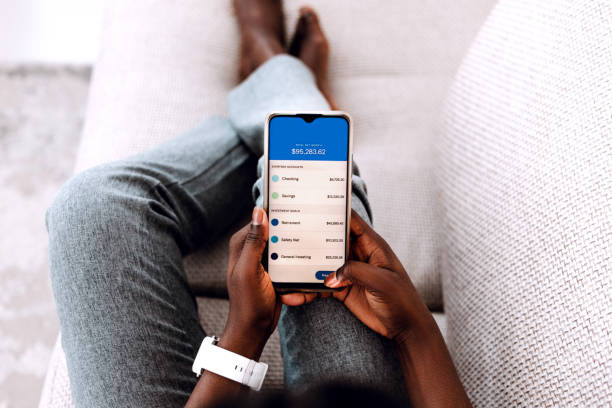

With technology weaving its way into every aspect of modern life, it’s no surprise that the financial sector has also undergone a transformative shift. Online savings accounts have emerged as a progressive and accessible alternative to traditional brick-and-mortar banking. Unlike their conventional counterparts, these digital savings accounts are hosted on secure platforms accessible through web browsers and mobile apps, ushering in a new era of financial convenience and flexibility.

READ ALSO;

- Car Insurance After DWI: Getting Back on the Road

- Defining Insurance Brokers: A Comprehensive Guide to Understanding Their Role and Importance

- Earnest Refinance Student Loans Review: An In-Depth Analysis

- Can I Cash Out an Annuity? A Comprehensive Guide

- Mastering Finance in Bachelor of Business Administration: A Comprehensive Guide

A Financially Inclusive Future

The allure of no minimum deposit is undeniably irresistible. By removing this financial threshold, online savings accounts have shattered the barriers that have historically prevented individuals from venturing into the realm of savings and investment. Whether you are a recent college graduate seeking to embark on a savings journey or a seasoned saver looking to diversify your portfolio, these accounts welcome you with open arms. The democratization of savings is at the heart of this movement, empowering individuals from all walks of life to take control of their financial destiny.

Unparalleled Flexibility

In the realm of online savings accounts with no minimum deposit, flexibility reigns supreme. Unlike traditional savings accounts that demand predetermined initial contributions, these modern digital solutions place the power in your hands. You have the autonomy to contribute any amount you desire, regardless of its magnitude. This unmatched flexibility allows you to tailor your savings strategy to your unique financial capacity and ever-changing life circumstances. Whether it’s a lump-sum deposit or a modest monthly contribution, your online savings account adapts to your needs, facilitating your journey towards financial prosperity.

Harnessing the Power of Compounding

Some might question whether the absence of a minimum deposit requirement comes at the cost of diminished interest rates. However, this is where online savings accounts defy expectations. Despite the lack of a substantial initial contribution, these accounts offer competitive interest rates that rival their traditional counterparts. As your money compounds over time, the growth of your savings accelerates exponentially, propelling you closer to your financial aspirations at a remarkable pace. The magic of compounding is not lost in the world of no minimum deposit online savings accounts, ensuring your money works relentlessly for you.

A Seamless Experience: Managing Your Savings with Ease

In addition to offering financial inclusivity, flexibility, and competitive interest rates, online savings accounts present a seamless and user-friendly management experience. With intuitive interfaces and easy accessibility, these accounts enable you to take charge of your finances like never before. Gone are the days of waiting in long queues at brick-and-mortar banks or struggling to find time for manual transactions. The convenience of managing your savings online is at your fingertips, available from the comfort of your home or while on the move, thanks to the marvels of modern technology.

As we embark on this journey into the world of no minimum deposit online savings accounts, we will unravel the many layers of their advantages and explore practical strategies for maximizing your savings potential. So, join us as we delve into the realm of financial empowerment, where accessibility, flexibility, and convenience converge, paving the way to a prosperous and secure financial future.

Strategies for Financial Growth: Making the Most of No Minimum Deposit Online Savings Accounts

With the stage set for financial empowerment through online savings accounts with no minimum deposit, it’s time to delve into the actionable strategies that will help you make the most of this modern financial tool. Armed with the knowledge of the unparalleled benefits these accounts offer, you are now poised to take control of your financial destiny and embark on a journey towards long-term prosperity.

Setting Clear Savings Goals

Before you embark on your savings journey, it’s essential to set clear and achievable financial goals. Define your objectives with precision, whether it’s building an emergency fund to safeguard against unexpected expenses, saving for a dream vacation, or putting money aside for a down payment on a home. Having specific goals in mind will serve as a compass, guiding you through the financial terrain and ensuring that every contribution to your online savings account serves a purpose.

Creating a Budget for Success

A well-crafted budget is the foundation of any successful savings plan. Track your income and expenses diligently to understand your spending patterns fully. Analyze your financial habits to identify areas where you can cut back and allocate more funds to your savings. The art of budgeting not only helps you live within your means but also empowers you to direct surplus funds into your online savings account regularly.

Embrace Automation for Consistency

Consistency is key when it comes to building a healthy savings habit. With the convenience of modern banking technology, you can set up automatic transfers from your primary checking account to your online savings account on a regular schedule. Automating your savings ensures that you don’t miss a beat, even during busy or hectic times. By making saving a routine part of your financial life, you’ll steadily build your savings without effort or temptation to divert funds elsewhere.

Unearthing the Potential of Bonuses and Rewards

In the realm of no minimum deposit online savings accounts, rewards and bonuses await savvy savers. Many financial institutions offer incentives, such as sign-up bonuses or rewards for reaching specific savings milestones. Keep a keen eye out for these opportunities and leverage them to give your savings a welcome boost. While these bonuses may seem small at first, they can add up significantly over time, contributing to your overall financial growth.

Resist the Temptation of Early Withdrawals

As you embark on your savings journey, you may encounter moments of temptation to withdraw funds for unplanned expenses or impulse purchases. It’s crucial to stay disciplined and remind yourself of the long-term benefits of keeping your savings intact. While the money in your online savings account is easily accessible, treat it as a dedicated reservoir for your financial goals. By resisting the urge for premature withdrawals, you safeguard the growth potential of your savings and maintain your path to financial success.

Regular Reevaluation for Continued Progress

Life is dynamic, and so are your financial circumstances. Regularly revisit your savings progress and evaluate whether your financial goals and objectives have evolved. Life events, such as changing jobs, starting a family, or pursuing further education, can impact your financial landscape. By reevaluating your savings plan periodically, you can make necessary adjustments to keep your goals aligned with your current reality.

Conclusion: Embrace Financial Empowerment with No Minimum Deposit Savings

In conclusion, the era of no minimum deposit online savings accounts brings with it a newfound sense of financial empowerment. The removal of barriers to entry, coupled with unmatched flexibility and competitive interest rates, has paved the way for a diverse range of individuals to take control of their financial futures.

By setting clear goals, creating a well-defined budget, and embracing the convenience of automation, you’ll embark on a savings journey that propels you towards financial prosperity. Leveraging the potential of bonuses and rewards while resisting early withdrawals will ensure that your savings grow steadily, unlocking the power of compounding to its full potential.

In this era of financial inclusivity and accessibility, seize the opportunity to cultivate a strong financial foundation and create a lasting legacy of financial security. Embrace the path to financial empowerment with no minimum deposit online savings accounts, where your financial goals are within reach, and your dreams are within grasp. Start your journey today and unlock the door to a brighter financial future.

Frequently Asked Questions (FAQ) about No Minimum Deposit Online Savings Accounts

1. What is a no minimum deposit online savings account?

A no minimum deposit online savings account is a digital savings account that allows you to open an account and start saving without requiring a specific initial deposit. Unlike traditional savings accounts, which often demand a substantial sum to activate the account, these modern digital solutions offer financial inclusivity by eliminating the minimum deposit requirement.

2. Are no minimum deposit online savings accounts safe?

Yes, no minimum deposit online savings accounts are safe and secure. Reputable financial institutions offering these accounts employ advanced security measures to protect your funds and personal information. As with any financial transaction, it is essential to choose a trusted and reputable institution to ensure the safety of your savings.

3. How do I benefit from a no minimum deposit online savings account?

No minimum deposit online savings accounts offer several benefits:

- Accessibility: These accounts are accessible to a wider range of individuals, irrespective of their initial financial capacity.

- Flexibility: You have the freedom to contribute any amount you desire, aligning with your financial capability and changing circumstances.

- Competitive Interest Rates: Despite not requiring a minimum deposit, these accounts still offer competitive interest rates, helping your money grow over time.

- Convenience: Online management allows you to track your savings, set up automatic transfers, and manage your account with ease.

- Peace of Mind: The absence of a minimum balance requirement relieves you from unnecessary stress, allowing you to focus on building a solid financial foundation.

4. Can I earn interest with a no minimum deposit online savings account?

Absolutely! Even without a minimum deposit, these accounts offer competitive interest rates. Your money will accumulate interest over time, helping you grow your savings and achieve your financial goals faster.

5. How do I open a no minimum deposit online savings account?

Opening a no minimum deposit online savings account is a simple and straightforward process. You can typically apply for an account online through the financial institution’s website. You may need to provide some personal information and identification documents as part of the account-opening process.

6. Can I set up automatic transfers to my online savings account?

Yes, most no minimum deposit online savings accounts allow you to set up automatic transfers from your checking account. This convenient feature ensures consistent savings by automatically transferring funds to your savings account on a schedule you choose.

7. Are there any fees associated with these accounts?

Fees and charges can vary depending on the financial institution and the specific account. However, many no minimum deposit online savings accounts have minimal or no fees. It’s essential to review the account terms and conditions to understand any potential fees before opening an account.

8. Can I access my no minimum deposit online savings account on my mobile device?

Yes, online savings accounts are designed to be accessible through web browsers and mobile apps. This means you can easily manage your account, track your savings, and make transactions using your mobile device, providing you with financial control on the go.

9. Is there a limit to how much I can save in these accounts?

The specific savings limit can vary depending on the financial institution and the type of account you choose. Some accounts may have a maximum balance cap, while others may allow unlimited savings. It’s essential to review the account details to understand any limits that may apply.

10. How can I maximize the benefits of a no minimum deposit online savings account?

To make the most of your no minimum deposit online savings account, consider the following strategies:

- Set clear and achievable savings goals.

- Create a budget to allocate funds to your savings regularly.

- Take advantage of automation for consistent savings.

- Look for bonuses and rewards to boost your savings.

- Avoid early withdrawals to maximize growth potential.

- Regularly reevaluate your financial goals and adjust your savings strategy accordingly.

Incorporating these practices into your financial planning will help you harness the full potential of a no minimum deposit online savings account and set you on a path towards financial success.